What an incredible (and eventful) year it's been! After a year filled with government shutdowns and economic recovery, I think we've come out strong and are ending this year on a great note! The Washington, D.C. metro/Montgomery County area has especially been a fortuitous place to be living. The winter real estate market is expectedly slower with the rush of […]

Case Shiller Price Index Shows A Spike In Home Prices In The West

According to the S&P Case-Shiller 10-and 20-City Housing Market Indices for September, home prices grew at an average of 13.30 percent year-over-year and achieved the highest growth rate for home prices since February 2006.

Get The Low Down On Pending And Existing Home Sales This Month

The National Association of REALTORS reported Monday that pending home sales dropped by -0.60 percent in October after falling at a revised rate of -4.60 percent in September.

Housing Market Index Shows Builder Confidence Remains Above 50

The National Association of Home Builders released its Housing Market Index for November on Monday. This month’s HMI reading was 54 against expectations of a reading of 55. Octoberâs reading was also 54 after being downwardly revised.

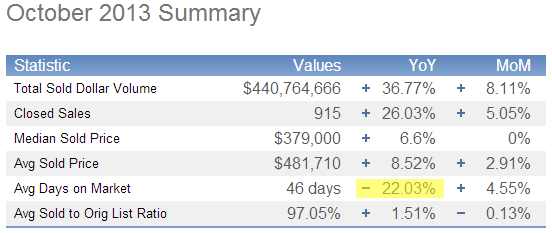

Market Update: November 2013

This month is looking great! Real estate agents everywhere in Montgomery County are moaning about seeing a slight slow down in the overall housing market. Since tax incentives ended in April and the busy summer months are over, agents say buyers are taking a break for the year. But we at the MSM Team see something else […]

What’s Ahead For Mortgage Rates This Week – November 4, 2013

Last week’s economic news came from a variety of sources. Most significant was the Fed’s Federal Open Market Committee statement after its meeting ended Wednesday. The statement indicated that the Fed saw moderate economic growth. FOMC did not taper its purchase of MBS and Treasury securities.

The FOMC statement announced the committee’s intention to closely monitor economic and financial developments “in the coming months,” which suggested that the FOMC is taking a wait-and-see position on reducing its $85 billion monthly asset purchases.

What You Should Know About Pending Home Sales This Month

Pending home sales fell in September by -5.60 percent, and were 1.20 percent lower year-over-year. This is the first time in more than two years that pending home sales have fallen below year-earlier readings. September’s reading was below August’s reading of -1.60 percent.

The National Association of REALTORS®, which released the report, expects lower home sales for the fourth quarter of 2013 and flat sales into 2014. NAR provided good news in its forecast of 10 percent growth in existing home sales in 2013 as compared to 2012.

What’s Ahead For Mortgage Rates This Week – October 28, 2013

Federal government agencies issued reports that were delayed by the government shutdown; and Freddie Mac reported that average mortgage rates fell for all types of loans it reports. The National Association of REALTORS issued its Existing Home Sales report on Monday. While 5.30 million home sales were expected an annual basis, September’s reading fell short at 5.29 million sales.

August’s reading was adjusted from an original reading of 5.48 million, which equaled July’s reading. Higher mortgage rates and home prices were cited as contributing to the slip in September’s sales.

The Government Shutdown And Its Effect On Existing Home Sales

Existing home sales for September fell by 1.90 percent from August’s revised reading of 5.39 million sales to 5.29 million sales. Economists had expected 5.30 million sales for September, so a slow-down in existing home sales had been anticipated.

The National Association of REALTORS cited higher home prices and mortgage rates as factors contributing to fewer sales of previously owned homes.

What’s Ahead For Mortgage Rates This Week – October 21, 2013

Many of the economic and housing reports typically scheduled were delayed by the federal government shutdown.

The National Association of Homebuilders Wells Fargo Housing Market Index for October was released Wednesday with a reading of 55, lower than the projected 58 and previous month’s revised reading of 57. The original reading for September was 58, which was the highest measure of builder confidence since 2005.